Belgian NGOs are doing a fine job. They often succeed in turning the pure survival agriculture of small-scale farmers or cooperatives into an economically viable activity that can raise the living standards of their families. But in order to achieve genuine growth, such as taking steps to capture new markets or carry out additional processes to their fruits or vegetables, they need capital.

Missing link

And that's where things often falter. The amounts they can borrow from an institution providing microfinance are far too small to enable them to finance what they wish to accomplish. And development finance institutions (DFIs) – such as Belgium's BIO – will only get involved if the investment amounts to at least 1 million euros.

For our NGOs, it is therefore quite frustrating, having to watch their excellent achievements ultimately fail to get off the ground after all. This was the reason why, in 2015, five Belgian NGOs – Rikolto, Louvain Coopération au Développement, Broederlijk Delen, Trias and Oxfam – joined forces to create Kampani: a social investment fund that specifically serves this missing link.

A socially oriented approach

Kampani invests amounts of between 100,000 euros and 500,000 euros with a fairly long investment horizon of 10 years. These investments are not intended to cover operating costs but to fund capital expenditure on items such as land, buildings, machinery and equipment. By operating in this way, the fund reaches small and medium-sized farms and cooperatives that are not catered for elsewhere. The fund specialises in the agri-food sector, in other words, the entire chain of food and non-food agricultural products, from production, storage and processing to marketing and consumption.

As a social investment fund, Kampani naturally applies a strong socially oriented approach, focusing on employment for women or indigenous communities. Farmers – who are often live in considerable poverty in remote locations – receive support to invest in automation, mechanisation and processing. This enables them to keep a greater share of the added value in the value chain for themselves.

Closely involved

Kampani is typically closely involved in the management of businesses or cooperatives. To that end, it will always delegate someone to sit on the board of directors. The fund also guarantees additional technical support in areas such as good agricultural practices or financial literacy. All of these are valid ways in which to reduce the risks of the investment.

What also helps reducing risks is the fact that Kampani mostly builds upon projects originally initiated by Belgian NGOs or by the Belgian development agency Enabel. The companies it invests in are therefore well known and have already proven their soundness.

Another important factor is that the fund is also scrupulously committed to due diligence. To ensure that the entire chain remains socially responsible and sustainable, it relies on outside consultants. They conduct a market analysis and analyse the company's financial viability, in addition to its social impact and governance.

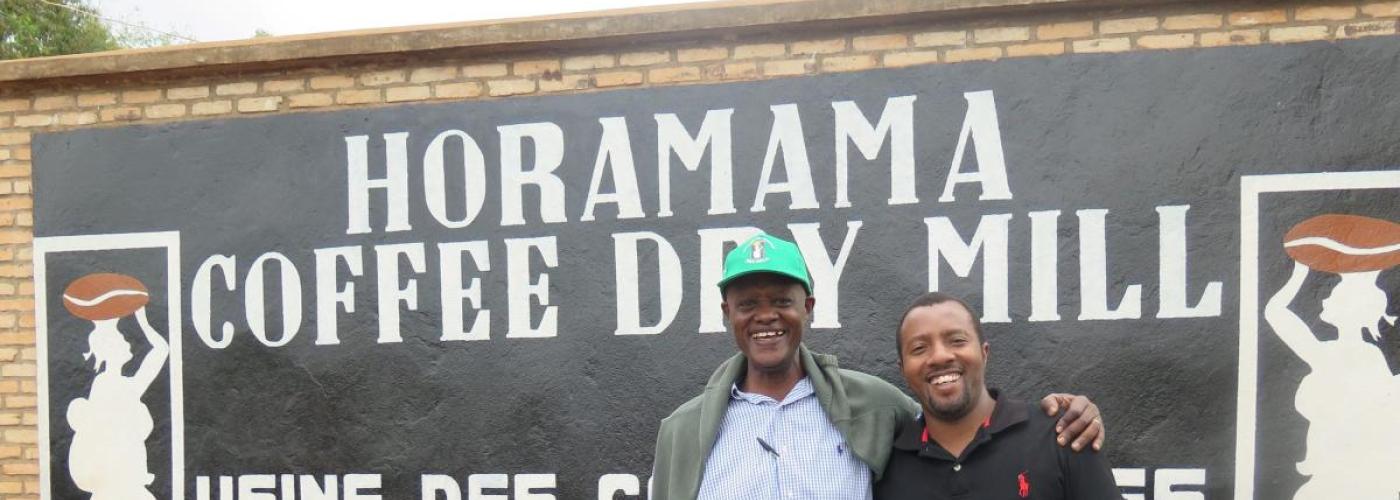

Burundi: a dry mill for coffee

The approach is clearly paying off! A great success story is COCOCA, a consortium of cooperatives of coffee growers in Burundi. As the largest grouping of small-scale coffee growers in Burundi, the consortium nowadays represents 15% of national production. And this is partly due to an investment by Kampani, which enabled COCOCA to make various purchases, including a ‘dry mill’.

A dry mill makes it possible for the coffee beans to be separated from fibres and gravel, after which they are peeled and then sorted by size, colour and weight – allowing to produce high-quality coffee ready for the market. Previously, COCOCA had to have those operations carried out elsewhere. Today, it can do them itself and the added value of the finished product flows directly back to the producers.

Processing the coffee in-house means that is also more traceable – meaning that it is possible to determine which farmer supplied a particular batch. That information is important when it comes to obtaining hallmarks such as fairtrade and organic. But close guidance from Broederlijk Delen and others has also played a crucial role in its success.

Benin: tinned pineapple juice

In Benin, Enabel has been supporting the expansion of the pineapple chain for many years. Amongst other things, this resulted in the company OJA – Original Jus d'Ananas – buying up pineapples from 135 small farmers in order to bottle the juice and export it to Niger and Burkina Faso. To capture new markets, the company wanted to produce pineapple juice in tins.

Kampani invested 150,000 euros, which not only enabled OJA to purchase a canning machine, but also to build a warehouse and get connected to the electricity grid. With increased sales, farmers will be able to sell more pineapples and therefore see their income increase.

No return

While this approach obviously works, the investment fund Kampani can only offer limited financial returns to investors. This is an inherent feature of the investment strategy it has chosen. The fund does aim for everyone to get at least their investment back, plus a return that is equal to inflation. After all, monitoring the businesses closely costs money. But this forms an essential part of the Kampani approach because it limits the risks in terms of management and so on. The target group itself also needs guidance. In addition, Kampani's projects may also be subject to external shocks such as natural disasters or political instability.

Kampani therefore attracts idealistic investors whose main goal is social impact and who are not expecting a profit. The issue is, however, that the pool of such investors is very small. The fund experienced this at first hand when it wanted to scale up its operations in 2020. Due to the high levels of risk, attracting additional investors was not an obvious step.

A grant for the purpose of risk reduction

At that point, the Belgian government intervened. The Directorate General for Development Cooperation of our FPS awarded a grant of €900,000 for the period 2021-2024. This enabled Kampani to lower its risk profile and win over new private investors.

This enabled Kampani to introduce an ‘initial loss tranche’. What this means is that in the event of a loss, Kampani will bear the first 5% of the loss itself. In other words, on a 100 euro share, the investor will only bear the cost of the loss from the 6th euro onwards. This significantly lowers the threshold for potential investors.

The grant also made it possible to reduce the investment risks on an individual transaction level. The types of risks to be mitigated include foreign exchange risks, political risks (by taking out insurance) and risks linked to market access (by obtaining certifications such as fairtrade and organic, and guaranteeing food safety and traceability). With the money, Kampani can also make the companies that need support investment ready – by strengthening their financial capacity, conducting feasibility and market studies and so on.

14 million euros, 19 deals

This small push from our FPS proved to be a shot in the arm. The size of the fund grew from 4 million euros to 14 million euros. Today, Kampani manages 19 deals across Africa, Latin America and Asia. A ginger processing plant in Peru, a cinnamon mill in Indonesia, banana ripening rooms in Tanzania, mango pulp production in Kenya, etc., the products are very diverse. In total, some 100,000 small-scale farmers are being reached directly.

The ambition is to become a fund of 20 million euros. That should make it possible to expand to a total of 40 deals. Currently, the investors – besides the NGOs already mentioned - are a number of private investors, the Katholieke Universiteit Leuven, the King Baudouin Foundation, the Boerenbond, CERA and a number of wealthy families.

A model worth emulating

For our FPS, Kampani is an important partner. Indeed, it forms the ideal bridge, on the one hand between traditional development organisations, such as NGOs and Enabel, that provide technical assistance through grants and, on the other hand, impact investors, such as BIO, which invest larger amounts and expect substantial returns.

Its investments in agricultural enterprises generate large and long-term benefits for the communities involved. In short, by focusing on the missing middle, Kampani is making a significant contribution towards efforts to combat poverty and hunger. For all of these reasons, it can quite rightly be regarded as a model to be emulated for other sectors such as healthcare and water.